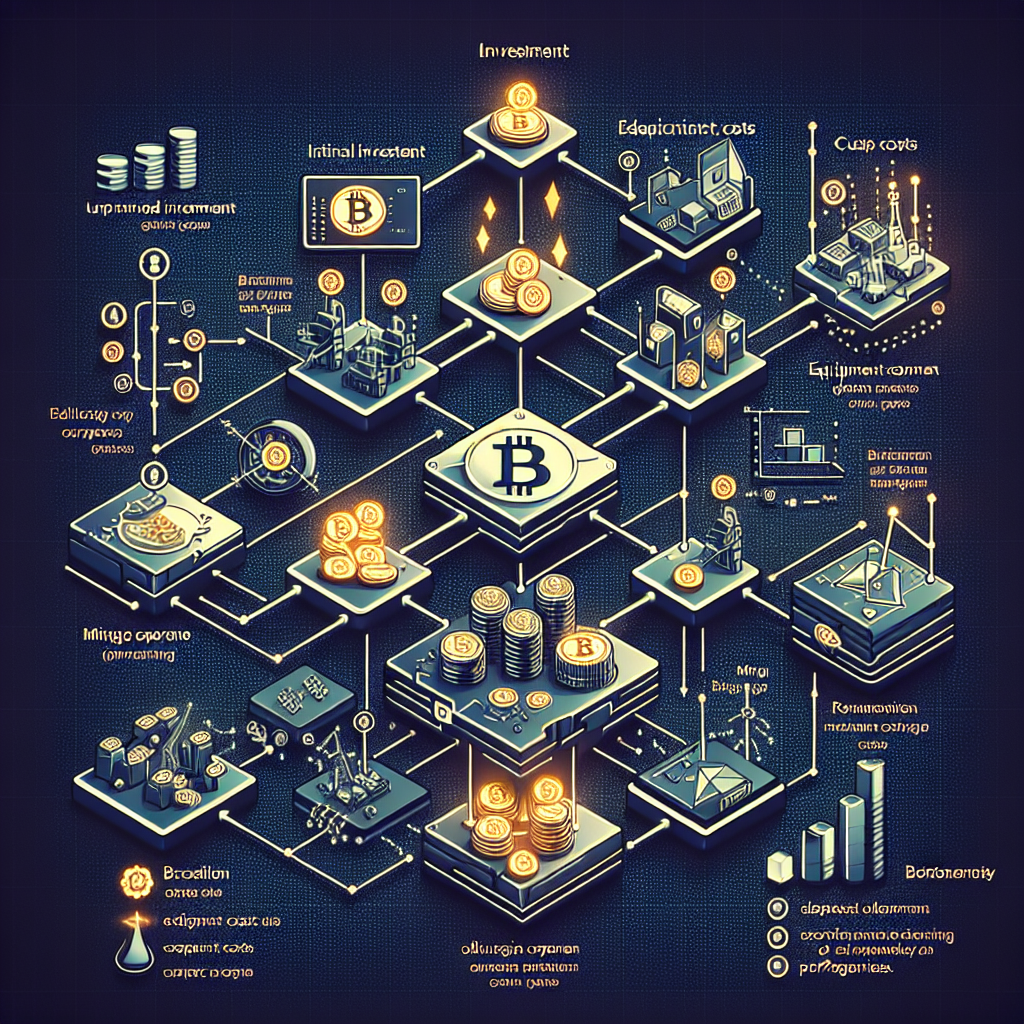

The Profitability of Cryptocurrency Mining: Process Explained

Understanding the profitability of cryptocurrency mining involves delving into the intricacies of the process. From the hardware and software used to the mining pools and rewards, this article provides a comprehensive overview of how individuals can make money through mining digital currencies.

Introduction

Welcome to the introduction section where we will provide an overview of cryptocurrency mining. Cryptocurrency mining is the process by which transactions are verified and added to the public ledger known as the blockchain. Miners play a crucial role in securing the network and ensuring the integrity of the cryptocurrency system.

Overview of Cryptocurrency Mining

Cryptocurrency mining involves using computer hardware to perform complex mathematical calculations that validate and secure transactions on the blockchain. Miners compete to solve these mathematical puzzles, with the first one to find the correct solution being rewarded with newly minted coins.

There are several key components to cryptocurrency mining, including mining hardware, mining software, mining pools, and mining rewards. Each of these elements plays a vital role in the overall profitability and success of a mining operation.

As we delve deeper into the intricacies of cryptocurrency mining, it becomes clear that this process is not only essential for the functioning of digital currencies but also offers individuals the opportunity to earn money through their participation in securing the network.

Stay tuned as we explore the mining process, profitability factors, risks, and the future outlook of cryptocurrency mining in more detail in the following sections.

Mining Process

When it comes to cryptocurrency mining, the process involves much more than just running a computer. It requires a combination of hardware, software, and collaboration with other miners in pools to maximize efficiency and profitability.

Mining Hardware

Choosing the right mining hardware is crucial for successful cryptocurrency mining. high-performance graphic cards, ASIC miners, and CPUs are commonly used to handle the complex mathematical calculations required to verify transactions on the blockchain.

investing in top-quality mining hardware can significantly Impact the speed and efficiency of your mining operation. However, it’s essential to consider factors like power consumption, cooling requirements, and upfront costs when selecting the hardware that best suits your needs.

Mining Software

Once you have your mining hardware set up, the next step is to install mining software. This software is responsible for connecting your hardware to the blockchain network, managing your mining activities, and monitoring your performance.

There are various mining software options available, each with its unique features and compatibility with different hardware setups. It’s essential to research and choose the software that aligns with your mining goals and technical capabilities.

Mining Pools

Joining a mining pool is a popular choice for many miners looking to increase their chances of earning rewards. Mining pools allow miners to combine their computational power and work together to solve complex algorithms more efficiently.

By joining a mining pool, miners can receive more frequent payouts based on their contribution to the pool’s total computational power. This collaborative approach to mining helps reduce the variance in rewards and provides a more stable income stream for participants.

Mining Rewards

The ultimate goal of cryptocurrency mining is to earn rewards for validating transactions and securing the network. Miners are rewarded with newly minted coins for successfully solving mathematical puzzles and adding new blocks to the blockchain.

In addition to block rewards, miners may also receive transaction fees for processing transactions on the network. The potential for earning rewards through mining depends on various factors, including the mining difficulty, network hash rate, and market value of the cryptocurrency being mined.

Profitability

Electricity Costs

One of the key factors that impact the profitability of cryptocurrency mining is electricity costs. Mining operations require a significant amount of electricity to power the hardware used to validate transactions on the blockchain. Miners must consider the cost of electricity in their region and the energy efficiency of their mining setup to ensure that the rewards from mining outweigh the expenses incurred from electricity consumption.

Miners can explore various strategies to optimize electricity costs, such as using energy-efficient hardware, taking advantage of off-peak electricity rates, or locating mining operations in regions with lower electricity prices. By carefully managing electricity costs, miners can improve their overall profitability and maximize their returns from mining activities.

Mining Difficulty

The mining difficulty of a cryptocurrency network is another crucial factor that influences the profitability of mining operations. Mining difficulty refers to the level of complexity involved in solving the mathematical puzzles required to validate transactions and add new blocks to the blockchain. As more miners participate in the network, the mining difficulty increases, making it harder to mine new coins and earn rewards.

Miners must constantly adapt to changes in mining difficulty by upgrading their hardware, adjusting their mining strategies, or joining mining pools to increase their chances of successfully mining blocks. Understanding and monitoring mining difficulty is essential for miners to stay competitive and profitable in the ever-evolving cryptocurrency mining landscape.

Market Value

The market value of the cryptocurrency being mined directly impacts the profitability of mining operations. The value of a cryptocurrency can fluctuate based on market demand, investor sentiment, regulatory developments, and other external factors. Miners must consider the market value of the coins they mine when assessing the potential returns from their mining activities.

Miners can monitor market trends, analyze price charts, and stay informed about industry news to make informed decisions about when to mine and sell their mined coins. By staying attuned to market value fluctuations, miners can optimize their profitability and capitalize on favorable market conditions to maximize their returns.

Return on Investment (ROI)

Calculating the return on investment (ROI) is essential for evaluating the profitability of cryptocurrency mining. ROI measures the efficiency and effectiveness of mining operations by comparing the costs incurred with the rewards earned over a specific period. Miners must consider factors such as hardware costs, electricity expenses, mining difficulty, and market value fluctuations when calculating their ROI.

Miners can use ROI calculations to assess the viability of their mining activities, identify areas for improvement, and make informed decisions about their mining strategy. By tracking ROI metrics and adjusting their approach accordingly, miners can enhance their profitability and achieve sustainable returns from their cryptocurrency mining endeavors.

Risks

Security Issues

One of the primary risks associated with cryptocurrency mining is the potential for security issues. As miners engage in validating transactions and adding blocks to the blockchain, they become targets for cyber attacks and hacking attempts. Malicious actors may attempt to disrupt mining operations, steal valuable information, or manipulate the blockchain for personal gain.

To mitigate security risks, miners must implement robust cybersecurity measures, such as using secure hardware and software, encrypting sensitive data, and regularly updating security protocols. Additionally, staying informed about the latest security threats and adopting best practices for safeguarding mining activities can help protect against potential security breaches.

By prioritizing security and taking proactive steps to address vulnerabilities, miners can minimize the risk of security issues impacting their profitability and overall success in the cryptocurrency mining space.

Regulatory Concerns

Another significant risk factor for cryptocurrency mining is regulatory concerns. The legal and regulatory landscape surrounding digital currencies is constantly evolving, with governments around the world implementing new policies and regulations that impact the mining industry. Miners must navigate a complex web of regulatory requirements, tax obligations, and compliance standards to ensure their mining activities remain lawful and sustainable.

regulatory uncertainty can create challenges for miners, as changes in legislation or enforcement actions may affect the profitability and viability of mining operations. Miners must stay informed about regulatory developments, engage with policymakers and industry stakeholders, and adapt their practices to comply with evolving legal requirements.

By proactively addressing regulatory concerns and maintaining a proactive approach to compliance, miners can mitigate the risks associated with regulatory uncertainty and position themselves for long-term success in the dynamic cryptocurrency mining ecosystem.

Future Outlook

As we look towards the future of cryptocurrency mining, it is essential to consider the impact of emerging technologies on the industry. The development of new hardware, software, and mining techniques continues to shape the landscape of mining operations and profitability.

Emerging Technologies

One of the most significant trends in emerging technologies for cryptocurrency mining is the rise of more energy-efficient hardware solutions. As the industry grapples with the environmental impact of mining activities, there is a growing emphasis on developing sustainable mining practices that reduce energy consumption and carbon emissions.

Companies are exploring innovative cooling solutions, renewable energy sources, and energy-efficient hardware designs to address the energy-intensive nature of mining operations. By leveraging emerging technologies, miners can improve the sustainability of their operations and enhance their profitability in a rapidly evolving market.

Another key area of focus for emerging technologies in cryptocurrency mining is the development of more advanced mining algorithms and protocols. As blockchain networks evolve and become more complex, miners must adapt to new challenges and opportunities presented by changes in network architecture and consensus mechanisms.

Researchers and developers are exploring novel approaches to consensus algorithms, such as proof-of-stake and sharding, to improve scalability, security, and efficiency in blockchain networks. By embracing these emerging technologies, miners can stay ahead of the curve and position themselves for success in the competitive world of cryptocurrency mining.

Industry Trends

In addition to emerging technologies, it is crucial to monitor industry trends that shape the future outlook of cryptocurrency mining. From regulatory developments to market dynamics, various factors influence the profitability and sustainability of mining operations.

One notable industry trend is the increasing focus on regulatory compliance and transparency in the cryptocurrency mining sector. Governments and regulatory bodies are implementing stricter oversight and enforcement measures to combat illicit activities, money laundering, and fraud in the industry.

Miners must stay informed about regulatory requirements, engage with policymakers, and adopt best practices for compliance to navigate the evolving regulatory landscape successfully. By demonstrating a commitment to regulatory compliance, miners can build trust with stakeholders, mitigate risks, and ensure the long-term viability of their mining activities.

Another industry trend that impacts the future outlook of cryptocurrency mining is the growing interest and investment in decentralized finance (DeFi) and non-fungible tokens (nfts). These emerging sectors of the blockchain ecosystem present new opportunities for miners to participate in innovative use cases and revenue streams beyond traditional mining activities.

Miners can explore partnerships with DeFi platforms, NFT marketplaces, and blockchain projects to diversify their revenue sources and expand their presence in the broader cryptocurrency ecosystem. By staying abreast of industry trends and embracing new opportunities, miners can position themselves for continued growth and success in the dynamic world of cryptocurrency mining.

Conclusion

In conclusion, cryptocurrency mining is a complex process that involves hardware, software, mining pools, and rewards. Miners play a vital role in securing the network and earning rewards for validating transactions on the blockchain. Factors such as electricity costs, mining difficulty, market value, and ROI impact the profitability of mining operations. Miners must also navigate security risks and regulatory concerns to ensure the sustainability of their activities. Looking ahead, emerging technologies and industry trends will continue to shape the future outlook of cryptocurrency mining, presenting new opportunities for miners to innovate and thrive in a dynamic and competitive landscape.

Comments