Legal Procedures for Starting a Business: Key Points for a Smooth Process

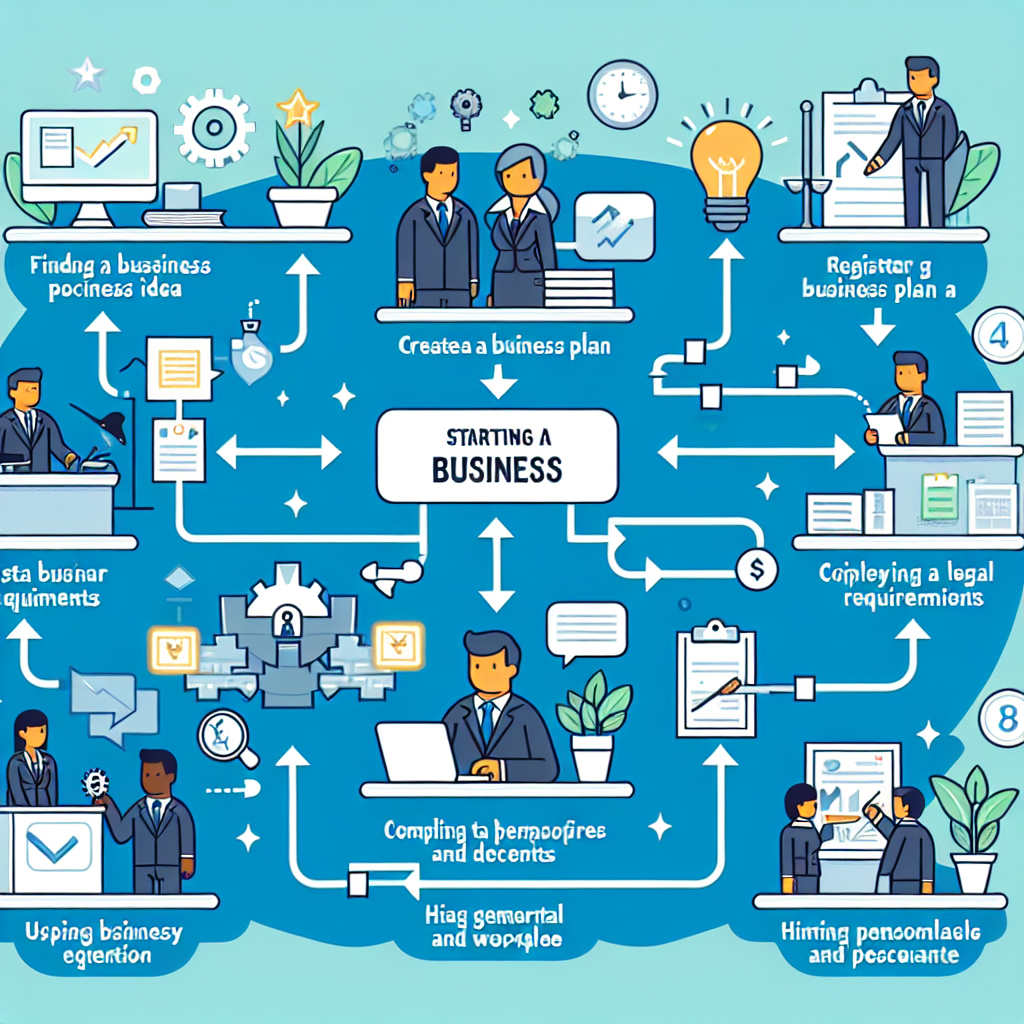

Starting a Business involves navigating through various legal procedures to ensure a smooth process. Key points to consider include creating a solid business plan, determining the appropriate legal structure, registering the business, obtaining necessary licenses and permits, understanding taxation requirements, complying with employment regulations, meeting insurance requirements, and ensuring legal compliance. This article provides an overview of the essential steps to take when starting a new business.

Overview

When starting a new business, having a clear overview of the key aspects is crucial for a successful venture. This section will provide a comprehensive look at the essential elements to consider before diving into the world of entrepreneurship.

Business Plan

A well-crafted business plan serves as the roadmap for your company’s success. It outlines your goals, strategies, target market, financial projections, and more. A solid business plan not only helps you stay focused but also attracts potential investors and lenders who want to see a clear vision for the future.

Legal Structure

Choosing the right legal structure for your business is a critical decision that can Impact your liability, taxes, and operations. Common options include sole proprietorship, partnership, limited liability company (LLC), and corporation. Each structure has its own advantages and disadvantages, so it’s essential to understand the implications of each before making a choice.

Business Registration

Registering your business is a crucial step in establishing its legitimacy and ensuring compliance with the law. It involves several key processes that must be followed to operate legally and avoid potential penalties.

Name Search

Before registering your business, you must conduct a name search to ensure that the name you have chosen is unique and not already in use by another entity. This step is essential to avoid any legal conflicts and confusion in the marketplace.

Filling Registration Forms

Once you have confirmed the availability of your chosen business name, you will need to fill out the necessary registration forms. These forms typically require information about your business, such as its name, address, type of business, ownership structure, and other relevant details.

It is important to provide accurate and complete information on the registration forms to avoid delays or rejection of your application. Depending on the legal structure you choose for your business, the registration requirements may vary, so it is essential to follow the specific guidelines provided by the relevant authorities.

After completing the registration forms, you will need to submit them along with any required documentation and fees to the appropriate government agency responsible for business registration. Once your application is processed and approved, you will receive a certificate of registration, officially recognizing your business as a legal entity.

Remember that business registration is not a one-time process; you may need to renew your registration periodically and update any changes to your business information to stay compliant with the law. Failure to maintain accurate and up-to-date registration can result in fines, penalties, or even the dissolution of your business.

By completing the business registration process diligently and accurately, you can establish a solid foundation for your business and demonstrate your commitment to operating ethically and legally. This step is essential for building trust with customers, partners, and other stakeholders, as well as protecting your business from potential legal issues in the future.

Licenses and Permits

Business License

Obtaining a business license is a fundamental requirement for operating legally in most jurisdictions. This license serves as proof that your business has met the necessary regulatory standards and is authorized to conduct its operations within the specified area. Failure to obtain a business license can result in fines, penalties, or even the closure of your business.

Special Permits

In addition to a general business license, certain industries or activities may require special permits to operate legally. These permits are specific to the type of business you are conducting and may involve additional regulations or inspections to ensure compliance with Safety, health, or environmental standards. It is essential to research and obtain any special permits required for your business to avoid any legal issues in the future.

Special permits may be necessary for businesses such as restaurants, bars, healthcare facilities, construction companies, or transportation services. These permits typically have specific requirements that must be met before they are issued, including zoning restrictions, health and safety standards, environmental impact assessments, or professional certifications.

Before starting your business operations, it is crucial to identify any special permits that may apply to your industry and ensure that you have obtained them before commencing business activities. Failure to comply with the regulations associated with special permits can result in fines, closure of your business, or legal action, so it is essential to prioritize obtaining the necessary permits to operate legally and responsibly.

By understanding the licensing and permitting requirements relevant to your business, you can demonstrate your commitment to compliance and ensure the smooth operation of your venture. Taking the time to research and obtain the appropriate licenses and permits not only protects your business from legal risks but also builds trust with customers, partners, and regulatory authorities.

Taxation

Tax Identification Number

Obtaining a Tax Identification Number (TIN) is a crucial step for businesses to comply with tax regulations. A TIN is a unique identifier assigned by the government to track tax obligations and payments. It is essential for filing tax returns, opening bank accounts, and conducting various financial transactions.

Businesses can apply for a TIN through the appropriate government agency, such as the Internal Revenue Service (IRS) in the United States. The application process typically requires providing information about the business, such as its legal name, address, ownership structure, and type of business activities.

Once a business obtains a TIN, it must use this number when filing tax returns, reporting income, and communicating with tax authorities. Failure to have a TIN or using an incorrect TIN can result in penalties, fines, or delays in processing tax-related documents.

Tax Obligations

Businesses have various tax obligations that must be fulfilled to comply with the law. These obligations may include paying income taxes, sales taxes, payroll taxes, property taxes, and other levies imposed by federal, state, or local governments.

It is essential for business owners to understand their tax obligations and ensure timely and accurate payment of taxes to avoid penalties or legal consequences. Working with a qualified tax professional or accountant can help businesses navigate complex tax laws, maximize deductions, and minimize tax liabilities.

Businesses must keep detailed records of their financial transactions, expenses, and income to support their tax filings and demonstrate compliance with tax laws. Failure to maintain accurate records or report income can result in audits, fines, or legal actions by tax authorities.

By staying informed about tax laws, fulfilling tax obligations, and seeking professional advice when needed, businesses can avoid tax-related issues and focus on growing their operations. Compliance with tax regulations is essential for the long-term success and sustainability of any business.

Employment Regulations

Understanding and complying with employment regulations is crucial for any business to operate legally and ethically. Labor contracts and employee benefits play a significant role in ensuring a fair and productive work environment.

Labor Contracts

Labor contracts are essential documents that outline the terms and conditions of employment between the employer and the employee. These contracts typically cover aspects such as job responsibilities, working hours, compensation, benefits, termination procedures, and other important details.

It is important for businesses to draft clear and comprehensive labor contracts to avoid misunderstandings and disputes in the future. By clearly defining the rights and obligations of both parties, labor contracts help establish a harmonious relationship between employers and employees.

Business owners should ensure that labor contracts comply with relevant labor laws and regulations to protect the interests of both parties. consulting with legal professionals or human resources experts can help businesses create legally sound and fair labor contracts that align with industry standards and best practices.

Employee Benefits

Employee benefits are an essential component of a competitive compensation package that can attract and retain top talent. These benefits go beyond salary and include perks such as health insurance, retirement plans, paid time off, bonuses, and other incentives.

Offering attractive employee benefits can enhance job satisfaction, improve employee morale, and increase productivity within the organization. Businesses that provide comprehensive benefits packages often enjoy higher employee retention rates and a more engaged workforce.

It is important for businesses to carefully design and communicate their employee benefits packages to ensure that they meet the needs and expectations of their workforce. Understanding the legal requirements and tax implications of offering employee benefits is also crucial to avoid compliance issues and financial penalties.

Regularly reviewing and updating employee benefits packages to align with industry trends and employee preferences can help businesses stay competitive in the job market and attract top talent. investing in employee benefits is not only a strategic business decision but also a way to demonstrate care and appreciation for the hard work and dedication of employees.

Insurance Requirements

Liability Insurance

Liability insurance is a crucial component of risk management for businesses. It provides protection against claims of negligence, personal injury, property damage, and other liabilities that may arise during the course of business operations. Having liability insurance can help safeguard your business assets and mitigate financial risks in the event of a lawsuit or legal dispute.

When selecting liability insurance coverage, it is essential to consider the specific risks associated with your industry and business activities. Different types of liability insurance, such as general liability, professional liability, product liability, and cyber liability insurance, offer varying levels of protection against different types of risks.

Business owners should carefully review their insurance needs with a qualified insurance agent or broker to determine the appropriate coverage limits and policy features. By investing in liability insurance, businesses can protect their interests, reputation, and financial stability in the face of unforeseen circumstances.

Worker’s Compensation

Worker’s compensation insurance is a mandatory requirement for businesses that have employees. This type of insurance provides coverage for medical expenses, lost wages, and disability benefits to employees who are injured or become ill due to work-related activities. Worker’s compensation insurance helps protect both employees and employers by ensuring that injured workers receive necessary medical care and financial support while shielding employers from potential lawsuits.

Business owners must comply with state regulations regarding worker’s compensation insurance to avoid penalties and legal consequences. The specific requirements for worker’s compensation coverage vary by jurisdiction, so it is essential to consult with an insurance provider or legal advisor to ensure compliance with the law.

By maintaining worker’s compensation insurance, businesses demonstrate their commitment to employee welfare and workplace safety. This insurance coverage not only provides financial protection for injured workers but also fosters a culture of responsibility and care within the organization.

Legal Compliance

legal compliance is a critical aspect of running a business to ensure that all operations are conducted within the boundaries of the law. By adhering to regulatory requirements and data protection laws, businesses can avoid legal issues and maintain a positive reputation in the market.

Regulatory Requirements

Regulatory requirements encompass a wide range of laws and regulations that businesses must comply with to operate legally. These requirements may include industry-specific regulations, environmental standards, consumer protection laws, and labor laws, among others. It is essential for businesses to stay informed about regulatory changes and ensure that their operations align with the latest legal requirements.

Failure to comply with regulatory requirements can result in fines, penalties, lawsuits, and reputational damage. By proactively addressing regulatory compliance, businesses can demonstrate their commitment to ethical practices and build trust with customers, partners, and regulatory authorities.

Data Protection Laws

data protection laws govern the collection, storage, and use of personal information by businesses. These laws aim to safeguard the privacy and security of individuals’ data and prevent unauthorized access or misuse. Businesses that handle customer data must comply with data protection regulations to protect sensitive information and maintain customer trust.

Key aspects of data protection laws include obtaining consent for data collection, implementing security measures to prevent data breaches, and providing individuals with control over their personal information. Non-compliance with data protection laws can lead to severe consequences, including hefty fines and legal actions.

By prioritizing data protection and implementing robust security measures, businesses can enhance customer confidence, mitigate risks of data breaches, and uphold their legal obligations. Investing in data protection not only protects the business but also fosters a culture of transparency and accountability in handling sensitive information.

Conclusion

Starting a new business involves navigating through various legal procedures to ensure a smooth process. From creating a solid business plan to understanding taxation requirements, complying with employment regulations, obtaining necessary licenses and permits, and ensuring legal compliance, there are several key points to consider. By following the essential steps outlined in this article, business owners can establish a strong foundation for their ventures and demonstrate their commitment to operating ethically and legally. Prioritizing legal procedures from business registration to insurance requirements and maintaining compliance with regulatory standards is crucial for long-term success and sustainability. By staying informed, seeking professional advice when needed, and investing in necessary resources, businesses can mitigate risks, build trust with stakeholders, and focus on growing their operations in a competitive market.

Comments